CALCULATING THOSE HIDDEN COSTS-TAKE ONE

Last week we discussed the costs that keep the life insurance policy afloat. We left the most complicated cost, cost of insurance, or “COI” for this week’s post.

Grab a cup of coffee, sit down, and buckle up, because this one is a bit more complicated than the previous posts.

Let’s start. The cost of insurance is the actual cost necessary to insure the specific person (or people, if the policy is a policy insuring two lives). This cost is calculated based on a fact pattern relating to the insured- their age, gender (sorry men, women live longer), smoking status (yes, smoking shortens life expectancy) and health condition. In short, the healthier, younger non-smoker gals will be less expensive to insure than the older, less healthy, smoking guys. Most carriers have several health ratings, from super preferred (think Bruce Springsteen) all the way to table ratings (Supersize Me).

Once the insured receives a health and smoking rating, they are assigned to an “insurance table”, which calculates the insurance rates per month.

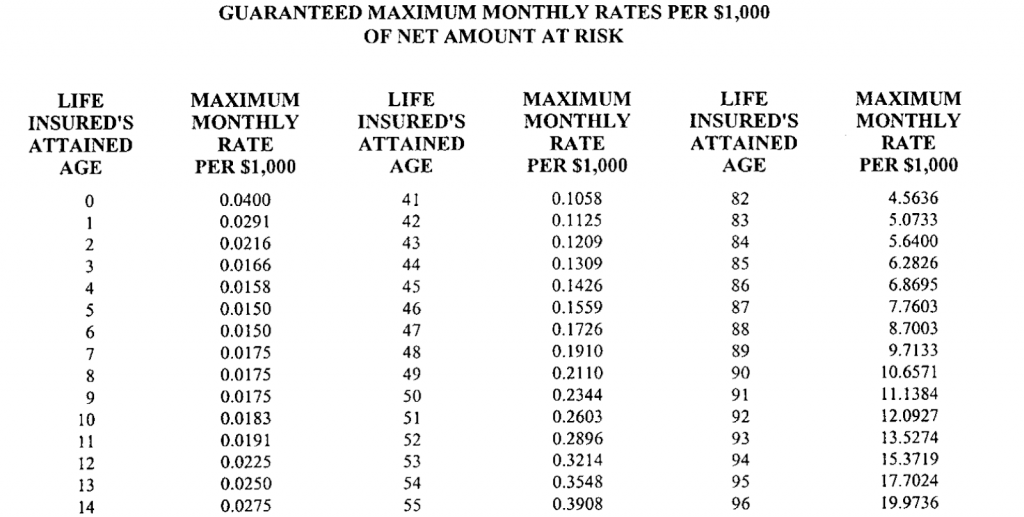

Here’s an example of how a COI rate chart looks:

These rates show what the COI is per each $1,000 coverage for each month. For example, for a 41-year-old, per each $1,000 of coverage, the insured will pay $0.1058 per month. Assuming the policy death benefit is $500,000, the monthly COI charge will be $52.9 (0.1058/1,000*500,000). This rate increases over time, because it becomes more expensive to insure older (and less healthy) people.

One more catch- the COI rate is charged for what is called in insurance jargon “amount at risk”. This means that the COI rate is multiplied only by the actual risk that the insurance company carries, which is not necessarily the entire death benefit amount (this applies to most policies).

For example, Jane has a $700,000 Universal Life policy, that has been in force for 20 years. Over the years, she paid $115,000 worth of premiums into the policy. After deducting fees, adding interest etc., she has a net cash value of $30,000. In this case, the amount at risk is not $700,000, but rather $670,000, as the carrier will use the cash value to pay out part of the death benefit. Usually, to calculate the COI here, we need to take the COI rate per $1000 and multiply it by $670,000 (and not by $700,000).

Look’s easy, doesn’t it? Unfortunately, it is much more complicated, because most carriers only include the COI charts in the original life insurance policy, which is not always available. Also, the COI rates in these charts are almost always the guaranteed rates, just like the guaranteed costs and interest that we discussed in earlier blog posts.

In other words, this is the highest COI rate that the carrier can charge, but in practice, the COI rates are almost always lower, sometimes significantly. Therefore, we need to figure out the non-guaranteed COI rates to have the full costs picture (it is worth noting that carriers have and will occasionally raise COI rates, and there are many lawsuits on this issue. More to follow in a future blog).

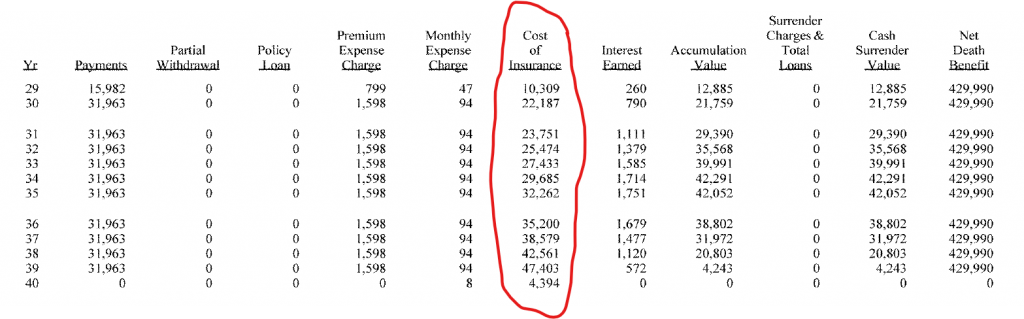

Before ranting against carrier’s tactics about hiding insurance costs, it is worth noting that there are a few (very few) righteous men in Sodom, who generally show what the non-guaranteed COI costs are in illustrations (some John Hancock policies, Voya Financial, a lot of Pacific policies). Take a look:

When we divide the cost of insurance by the total amount at risk (death benefit less the cash value) for the period, we will have the COI per $1,000.

In our next post, we will discuss how to deduce the COI rates from illustrations, when we do not have this information readily at hand.

Try to see whether the illustration (and sometimes the annual statement) has non-guaranteed COI rates. This will save you a lot of time and cups of coffee.

Join us again next week for a detailed explanation of these documents.

The contents do not constitute legal advice, are not intended to be a substitute for legal advice and should not be relied upon as such. You should seek legal advice or other professional advice in relation to any particular matters you or your organization may have.