Business summary

LiST dramatically expands the Life Settlement market by creating a new and efficient marketplace offering investors of all sizes the opportunity to freely enter the Life Settlements market.

LiST enables investors to invest in a transparent, diversified, and highly liquid format while simultaneously helping the policy owners maximize the value of their policy.

Problem

Investor Barriers

- The need of deep pockets to diversify the longevity risk.

- The need of expertise to manage the ongoing cash flow and to run a Due Diligence on policies.

- Lacking of liquidity.

Policy Sellers

- Lacking transparency and reputation for exploiting seniors.

- “All or nothing” – It’s a one-time transaction based on current value only.

Solution

LiST provides a Marketplace for trading portions of life insurance policies.

Example

- John Smith, a policy owner, turns to the LiST platform.

- LiST establishes a specific SPV that becomes the beneficiary of John’s policy.

- The SPV’s majority beneficiary is John himself.

- On a quarterly basis, the SPV issues notes to investors who fund the note, and through this vehicle, fund the premiums.

- LiST guarantees to be the “last resort” in case the notes don’t get a bid from investors, funding those notes.

- When policy reaches maturity, the proceeds are distributed between John and the lenders based on a predetermined formula.

Advantages

Investor

- Diversified risk with smaller capital – Enables the small and medium investors tap in to a great investment opportunity.

- No need of expertise and free of the premium risk.

- Fully liquid investment – can sell before policy maturity with high return.

Policy holder

- Free of premiums without surrendering policy.

- Can sell bit by bit, maximize the value, based on needs and real market biding.

- Liquid asset when still alive.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Market Summary

- 40-50$B market potential.

- Pure alpha non correlated investment.

- 12-19% IRR.

- Highly regulated.

- Competition – current investors including Berkshire, Apollo, Vida, Blackstone etc.

LiST Business Model

LiST receives a fixed percentage in every policy from the policy owner, and a management fee from the investors.

Team

Yaacov Goldenhersh – CEO

6 years of experience in the business department of the IAF managing and negotiating projects of over 400M$

F16I pilot for the IAF

Izik Algarisi – CTO

12 years of development experience with the past 3 years as CTO managing a team of 10

Over 5 years teaching at the external school of the Technion institute

Yaakov Bergman – COO

7 years of experience in high tech managing product and strategy.

5 years of consulting for start-up ventures

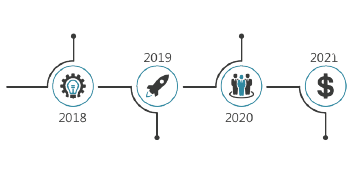

LiST Status

Alumni of the Barclays accelerator powered by Techstars, Tel Aviv, 2018.

Post Seed, Pre-Revenue.

Capital raised – $2M