WHAT IS A LIFE SETTLEMENT?

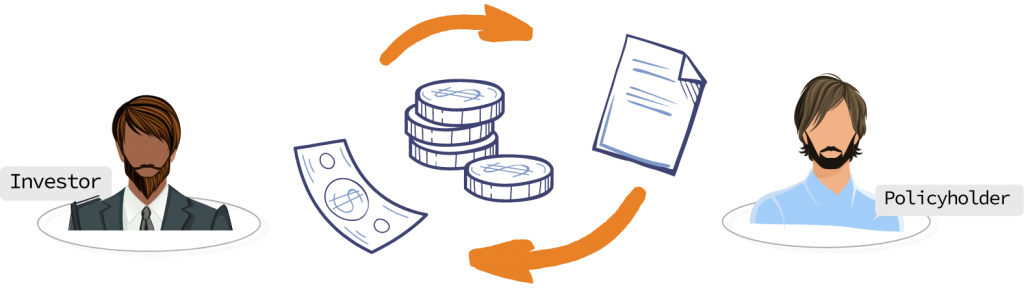

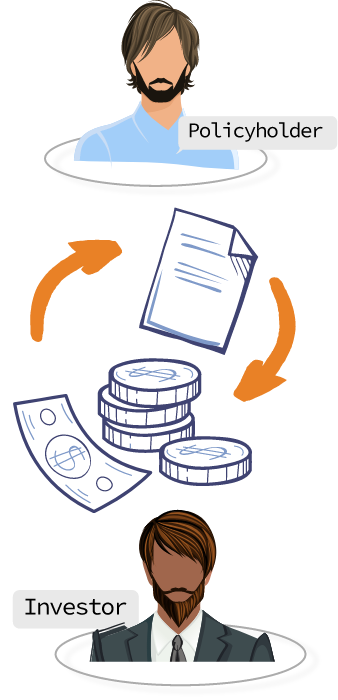

A Life Settlement is the sale of an existing life insurance policy to a third party.

Typically, policyholders selling their policies are senior citizens with premiums that they can no longer afford or with an unwanted or unneeded policy.

The selling policyholder receives a payment that is higher than the policy’s cash surrender value but less than its death benefit.

The policy’s buyer pays all future premiums.

Once the transaction is complete, the ownership is transferred to the buyer, who becomes the owner and beneficiary. The original policyholder’s beneficiaries will no longer be entitled to benefits upon the original policyholder’s death.

WHAT IS A LIFE SETTLEMENT?

A Life Settlement is the sale of an existing life insurance policy to a third party.

Typically, policyholders selling their policies are senior citizens with premiums that they can no longer afford or with an unwanted or unneeded policy.

The selling policyholder receives a payment that is higher than the policy’s cash surrender value but less than its death benefit.

The policy’s buyer pays all future premiums.

Once the transaction is complete, the ownership is transferred to the buyer, who becomes the owner and beneficiary. The original policyholder’s beneficiaries will no longer be entitled to benefits upon the original policyholder’s death.

LET'S START FROM THE BEGINNING!

Life Settlements were established at the beginning of the 20th century by a patient who lacked sufficient funds to undergo surgery and used his life insurance policy as payment to the surgeon. When this transaction was challenged in court, in the case known as Grigsby v. Russell, the U. S. Supreme Court ruled that a life insurance policy is, in fact, a private property and may therefore be sold and its ownership transferred.

Life Settlements were established at the beginning of the 20th century by a patient who lacked sufficient funds to undergo surgery and used his life insurance policy as payment to the surgeon. When this transaction was challenged in court, in the case known as Grigsby v. Russell, the U. S. Supreme Court ruled that a life insurance policy is, in fact, a private property and may therefore be sold and its ownership transferred.

Because of a low correlation to the erratic stock market and insurance carriers’ consistently highly-rated credit, this type of investment was attractive to investors who wanted to diversify their portfolios with investments outside standard markets.

Because of a low correlation to the erratic stock market and insurance carriers’ consistently highly-rated credit, this type of investment was attractive to investors who wanted to diversify their portfolios with investments outside standard markets.

Regulations provided the first line of defense, yet many policyholders and small investors did not have the knowledge, means, and skills to conduct a proper investigation when selling or purchasing a life insurance policy. Additionally, frequent exploitation of seniors and a lack of transparency in the Life Settlements Market resulted in a deficient market. Rather than deal with this broken market, many policyholders chose to lose money by surrendering their policies or allowing them to lapse and many investors passed on a great investment opportunity.

Regulations provided the first line of defense, yet many policyholders and small investors did not have the knowledge, means, and skills to conduct a proper investigation when selling or purchasing a life insurance policy. Additionally, frequent exploitation of seniors and a lack of transparency in the Life Settlements Market resulted in a deficient market. Rather than deal with this broken market, many policyholders chose to lose money by surrendering their policies or allowing them to lapse and many investors passed on a great investment opportunity.

BASIC TERMS

Cash (surrender) value – the sum of money an insurance company pays to a policyholder in the event that their policy is voluntarily terminated before its maturity.

Face amount – the amount of money that is paid when the policyholder dies or when their policy matures.

Premium “illustration” – a set of projections, prepared by the actuarial department of the insurance company. It shows how your policy will perform in the future. It includes financial projections for each year.

Premium optimization – an arrangement under which only the premium is paid without the savings element, which causes significant fluctuations in the premium rate.

Life expectancy – a statistical measure of the average time a person is expected to live, based on the year of their birth, their current age, and other demographic factors including gender.

DIFFERENT

PEOPLE

DIFFERENT

POLICIES

- Policy type: Universal life insurance policies are the most common in the Life Settlements Market, but convertible term policies are also eligible sometimes.

- Age/Health:Life insurance sellers are usually over 65 years old or have a serious medical condition.

- Policy Value: Most policies have a face value of $100,000 or more.

- Contestability: In most states, a policy must be purchased at least two and up to five years before it is sold.

FACTS AND FIGURES

Over 100,000 policyholders, who own policies with combined face values of more than 100 billion dollars, allow their policies to lapse every year.

Every year, policyholders lose 8.8 billion dollars in residual policy value that they could have received through Life Settlements.

Life Settlements payments average seven times more than a policy’s cash surrender value.

MEET THE PLAYERS

Policyholder – a person or persons who own a life insurance policy.

Life Settlements Investor – an individual or group of individuals who purchase life insurance policies from policyholders.

Life Settlements financial firms – firms engaged in Life Settlements investments. Regulations prohibit direct buying from policyholders – companies may only buy through providers.

Life Settlements broker – a state licensed agent representing sellers in Life Settlements transactions.

Life Settlements provider – a state licensed agent representing buyers in Life Settlements transactions and handling the procedure of ownership transfer.

Life expectancy provider – actuarial firms engaged in life expectancy evaluation.

Pricing provider – policy pricing firms.

Legal firms – law firms specializing in Life Settlements.

Trust services – assets are usually held by trust services.

Consultants – these are usually people who support the policy sellers but do not have a broker’s license.

Industry services – firms that provide various ancillary services in this industry.

LiST – Next-gen asset management powered by data.